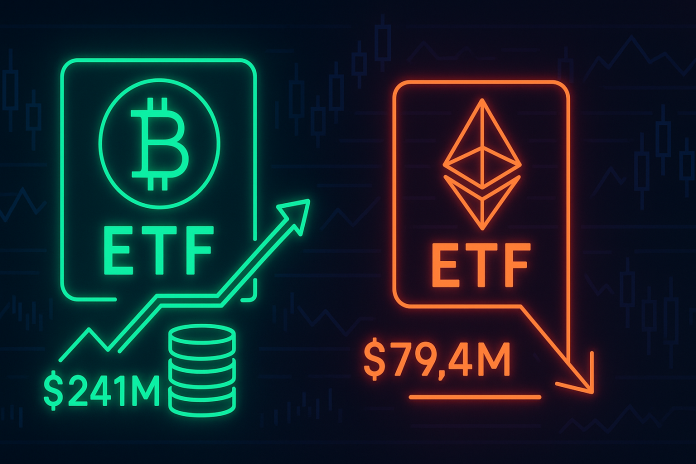

The crypto market closely tracks institutional activity, and the latest numbers have sparked significant attention. After two consecutive days of outflows, bitcoin spot etf inflows returned strongly with $241 million added yesterday. This marks a notable shift in sentiment, as investors reversed the trend that had been causing uncertainty in Bitcoin markets. At the same time, Ethereum spot ETFs recorded $79.40 million in outflows, extending their losing streak to three days.

The renewed bitcoin spot etf inflows matter not just because of the size but also because of the timing. Institutional investors often set the tone for broader market direction, and their collective moves can signal confidence or caution. The return of hundreds of millions into Bitcoin ETFs suggests that demand remains resilient, even in the face of short-term volatility. This has implications for Bitcoin’s price stability, its role in portfolios, and the long-term outlook for adoption.

Bitcoin ETFs have quickly become one of the most important tools for traditional investors to gain exposure to digital assets. Unlike futures-based products, spot ETFs provide direct exposure to Bitcoin’s price performance, attracting both retail and institutional capital. The rise of these instruments highlights the growing integration of crypto into mainstream finance. Each swing in bitcoin spot etf inflows offers insights into investor psychology and market sentiment.

This article explores the significance of the $241 million inflow, the broader context of Bitcoin ETF activity, and what the contrasting flows between Bitcoin and Ethereum might mean for the digital asset landscape. We will also examine the historical patterns of ETF flows, the macroeconomic backdrop, and the potential strategies traders can adopt based on these developments.

1. Understanding Bitcoin Spot ETF Flows

1.1 What Inflows and Outflows Represent

ETF flows provide a window into investor sentiment. When bitcoin spot etf inflows rise, it means capital is entering the market through regulated channels, reflecting confidence and appetite for exposure. Outflows, on the other hand, suggest profit-taking, risk reduction, or shifts to other assets.

1.2 Why the $241 Million Inflow Stands Out

The return of $241 million after two days of outflows is significant. It not only reverses the recent negative trend but also positions Bitcoin ETFs as a stabilizing force in the market. Such a strong inflow demonstrates that institutions and large investors remain willing to commit substantial capital.

1.3 Bitcoin vs. Ethereum Flows

While bitcoin spot etf inflows surged, Ethereum ETFs experienced $79.40 million in outflows. This divergence highlights differences in sentiment between the two leading digital assets. It suggests that, at least for now, investors favor Bitcoin over Ethereum as a safer or more compelling bet.

1.4 ETF Flows as a Market Signal

ETF flows are often used as leading indicators. Traders interpret strong bitcoin spot etf inflows as a bullish signal for price direction. While not perfect, the consistency of this pattern makes ETF flow analysis a valuable tool for market participants.

2. Historical Context of Bitcoin ETF Flows

2.1 Early Launch and Growth

Since their introduction, Bitcoin ETFs have become one of the fastest-growing products in financial markets. The size of bitcoin spot etf inflows has steadily increased, reflecting rising adoption by institutional players.

2.2 Periods of Strong Inflows

Past inflow surges have coincided with bullish phases in Bitcoin’s price cycle. For example, when inflows spiked during early 2024, Bitcoin rallied significantly. These patterns suggest that inflows often precede or accompany strong upward price moves.

2.3 Outflow Streaks and Corrections

Outflow streaks, like the two-day period before the latest inflows, often align with corrections or consolidations. However, the return of bitcoin spot etf inflows indicates resilience and the ability of the market to attract fresh capital even after short-term weakness.

2.4 Comparing to Other Asset Classes

The growth of Bitcoin ETFs mirrors the early days of gold ETFs. Just as inflows into gold ETFs helped establish gold as a mainstream investment, sustained bitcoin spot etf inflows could solidify Bitcoin’s role in institutional portfolios.

3. Institutional Demand and Sentiment

3.1 Hedge Funds and Asset Managers

Institutional players such as hedge funds and asset managers rely on ETFs for exposure without the complexities of direct custody. The surge in bitcoin spot etf inflows demonstrates that these groups remain engaged in the digital asset space.

3.2 Retail Investor Participation

ETFs also attract retail investors who prefer simplicity and regulation. The $241 million inflow indicates that demand is not limited to large institutions but includes diverse market participants.

3.3 Sentiment Shifts

After two days of outflows, some feared sentiment was turning negative. The strong bitcoin spot etf inflows suggest those fears may have been overblown. Confidence remains intact, and the trend could encourage more investors to re-enter.

3.4 Impact on Market Confidence

ETF flows influence confidence beyond Bitcoin itself. When bitcoin spot etf inflows rise, they send a signal of legitimacy and resilience to the entire crypto market, potentially lifting sentiment across altcoins as well.

4. Bitcoin vs Ethereum Divergence

4.1 Contrasting Flows

The split between Bitcoin’s $241 million inflow and Ethereum’s $79.40 million outflow highlights diverging investor priorities. While Bitcoin gains momentum, Ethereum faces skepticism in the short term.

4.2 Factors Behind Bitcoin’s Strength

The strength of bitcoin spot etf inflows reflects Bitcoin’s established role as digital gold. Investors may perceive Bitcoin as safer during uncertain conditions, while Ethereum’s narrative is more tied to innovation and risk.

4.3 Ethereum’s Outflow Streak

Three consecutive days of Ethereum ETF outflows raise questions about investor confidence. While Ethereum remains a vital platform, the lack of inflows contrasts sharply with Bitcoin’s current momentum.

4.4 Implications for Market Strategy

For traders, the divergence suggests opportunities. The strength of bitcoin spot etf inflows supports a bullish outlook on BTC, while Ethereum’s weakness may present either caution or a contrarian buying opportunity, depending on risk tolerance.

5. Why ETF Flows Matter for Bitcoin

5.1 Indicator of Institutional Confidence

Bitcoin spot etf inflows are more than just numbers; they reflect the confidence of institutional investors. When large capital allocators choose regulated ETFs over direct Bitcoin holdings, it shows a preference for compliance, transparency, and mainstream acceptance. The $241 million inflow is an example of how institutions continue to see Bitcoin as a legitimate asset class.

5.2 Influence on Market Liquidity

Every rise in bitcoin spot etf inflows increases liquidity in the broader Bitcoin market. More liquidity means tighter spreads, lower volatility in execution, and a more mature market structure. These improvements make Bitcoin more attractive to conservative investors who may otherwise avoid the asset due to perceived instability.

5.3 Role in Price Discovery

ETF flows play a role in price discovery. Strong inflows typically correlate with upward price pressure, while outflows can dampen momentum. Bitcoin spot etf inflows therefore serve as both a symptom and a cause of market movements.

5.4 Feedback Loops in Market Psychology

When inflows rise, traders interpret it as bullish, which can trigger further buying and more inflows. Similarly, outflows can create negative sentiment. The $241 million inflow shows how quickly psychology can shift back to optimism.

6. Historical Comparisons to Gold ETFs

6.1 The Gold ETF Precedent

Gold ETFs transformed the precious metals market when they launched in the early 2000s. Bitcoin spot etf inflows are often compared to these early adoption phases, with similar potential to redefine how investors engage with a scarce asset.

6.2 Growth Trajectories

Gold ETFs grew rapidly during their first decade, eventually accounting for a large portion of global demand. Analysts argue that if bitcoin spot etf inflows follow a similar trajectory, Bitcoin could experience long-term structural growth.

6.3 Institutional Legitimacy

The success of gold ETFs gave institutions a trusted vehicle for exposure. Bitcoin spot etf inflows serve the same purpose, helping conservative investors overcome barriers to entry.

6.4 Potential Differences

Unlike gold, Bitcoin has higher volatility and evolving technology. These differences mean that while bitcoin spot etf inflows may mirror gold’s path, they may also face unique challenges.

7. Macro and Economic Influences

7.1 Interest Rate Environment

Low interest rates historically drive capital into risk assets. Bitcoin spot etf inflows often increase during periods of monetary easing. Conversely, higher interest rates may reduce appetite, as investors can earn yields elsewhere.

7.2 Inflation and Currency Concerns

Bitcoin is often seen as a hedge against inflation. Rising inflationary pressures have historically correlated with stronger bitcoin spot etf inflows, as investors look for protection from currency debasement.

7.3 Global Liquidity Trends

Central bank policies affect liquidity worldwide. Expansive liquidity environments generally support bitcoin spot etf inflows, while tightening cycles create headwinds.

7.4 Geopolitical Factors

Political instability or global crises often lead investors to seek alternative stores of value. Bitcoin spot etf inflows rise during these times as capital flows into perceived safe havens.

8. Short-Term vs Long-Term Signals

8.1 Short-Term Market Impact

The $241 million inflow provided immediate relief to markets, boosting sentiment and stabilizing prices. Bitcoin spot etf inflows often have a noticeable short-term effect, particularly when they break negative streaks.

8.2 Long-Term Adoption

More important than daily fluctuations is the long-term trend. Consistent bitcoin spot etf inflows point toward sustained institutional adoption, which strengthens Bitcoin’s role in global finance.

8.3 Volatility Considerations

While inflows are bullish, Bitcoin remains volatile. Traders must balance optimism with risk management, understanding that bitcoin spot etf inflows are one piece of a complex puzzle.

8.4 Portfolio Diversification

For investors, steady inflows suggest that Bitcoin is becoming a more accepted portfolio diversifier. The rise of regulated ETFs reduces barriers, making allocation easier for both individuals and institutions.

9. Ethereum Outflows in Contrast

9.1 The $79.40 Million Outflow

While Bitcoin spot etf inflows returned, Ethereum ETFs recorded $79.40 million in outflows. This contrast highlights diverging investor sentiment between the two largest digital assets.

9.2 Possible Explanations

Ethereum’s outflows may be tied to uncertainty around scaling upgrades, competition from other blockchains, or weaker narratives compared to Bitcoin’s digital gold positioning.

9.3 Impact on Ethereum Price

Three consecutive days of outflows place downward pressure on Ethereum’s price. While Bitcoin benefits from renewed inflows, Ethereum struggles with investor hesitancy.

9.4 Broader Implications

The divergence underscores the different roles Bitcoin and Ethereum play. Bitcoin spot etf inflows reflect its status as a store of value, while Ethereum’s challenges reveal the risks of being tied to innovation cycles.

10. Strategies for Traders

10.1 Following ETF Flow Data

Traders can use bitcoin spot etf inflows as a sentiment indicator. Large positive inflows often precede rallies, while outflows may signal caution.

10.2 Hedging Approaches

With flows shifting between Bitcoin and Ethereum, traders may hedge positions by balancing exposure to both assets. This helps mitigate risks when one asset experiences sustained outflows.

10.3 Long-Term Accumulation

For long-term investors, consistent bitcoin spot etf inflows are a green light to accumulate. Steady institutional adoption supports a thesis of structural growth.

10.4 Short-Term Volatility Plays

Day traders can capitalize on volatility spikes that often follow large inflows or outflows. The $241 million inflow could provide momentum-based opportunities in the short run.

11. Broader Impact on Crypto Markets

11.1 Influence on Altcoins

When bitcoin spot etf inflows rise, the entire crypto market feels the impact. Investors often rotate profits from Bitcoin into altcoins, creating secondary rallies. This spillover effect means that ETF activity indirectly boosts liquidity across the ecosystem.

11.2 Market Legitimacy

Sustained bitcoin spot etf inflows strengthen the argument that crypto is moving into the financial mainstream. With regulated investment vehicles attracting billions in capital, skepticism about Bitcoin as a fringe asset is increasingly harder to sustain.

11.3 Investor Education

ETF growth also plays a role in educating new investors. Many individuals who might avoid direct crypto purchases feel more comfortable investing through ETFs. This expanding base of educated investors reinforces adoption.

11.4 Comparison With Futures Products

Futures-based ETFs often track Bitcoin prices with slippage and higher costs. Spot ETFs, supported by strong bitcoin spot etf inflows, offer a more accurate and cost-effective vehicle. This efficiency helps expand adoption further.

12. Looking at the Next Quarter

12.1 Seasonal Patterns

Crypto markets often display seasonal tendencies. Historically, bitcoin spot etf inflows have increased during periods of market optimism, such as post-halving cycles or after strong quarterly earnings seasons in traditional markets.

12.2 Institutional Positioning

Institutions rebalance portfolios at the end of each quarter. If bitcoin spot etf inflows remain strong, it could suggest that Bitcoin is becoming a standard allocation in diversified portfolios.

12.3 Ethereum’s Recovery Potential

Although Ethereum is currently facing outflows, recovery is possible if scaling upgrades deliver results or if narratives like tokenization gain traction. Investors will closely compare its flows to Bitcoin’s.

12.4 Global Market Drivers

Events such as central bank policy decisions, geopolitical tensions, or major regulatory announcements could all influence bitcoin spot etf inflows in the coming months.

13. Risks to Watch

13.1 Regulatory Developments

While ETFs offer legitimacy, regulatory changes remain a major risk. Sudden policy shifts in the United States or Europe could slow bitcoin spot etf inflows and impact market confidence.

13.2 Market Corrections

Rapid price increases can lead to overheated markets. If inflows push Bitcoin too quickly, corrections may follow. Traders must remain aware that even positive bitcoin spot etf inflows can precede volatility.

13.3 Competition From Other Assets

Rising yields in traditional markets, such as bonds or equities, may divert capital away from Bitcoin. If returns in these markets appear safer, bitcoin spot etf inflows could slow.

13.4 Technical Challenges

Market infrastructure, custody solutions, or liquidity mismatches could create operational risks. While unlikely, such events could disrupt the smooth growth of bitcoin spot etf inflows.

14. Opportunities Ahead

14.1 Institutional Growth

The clearest opportunity lies in institutional adoption. As more pension funds, endowments, and sovereign wealth funds allocate capital, bitcoin spot etf inflows are expected to accelerate.

14.2 Integration With Financial Products

Future integration of Bitcoin ETFs into retirement plans and structured products will broaden access. Strong bitcoin spot etf inflows set the foundation for this expansion.

14.3 Cross-Market Synergies

Bitcoin ETF inflows can create synergies with other digital assets, stablecoins, and tokenized products. Each inflow strengthens the overall ecosystem and builds momentum for broader adoption.

14.4 Long-Term Price Implications

Sustained inflows point toward long-term price appreciation. While short-term volatility remains, bitcoin spot etf inflows provide structural support for upward trends.

15. Strategic Takeaways

15.1 For Traders

Short-term traders should track daily bitcoin spot etf inflows as a sentiment indicator. Large inflows often lead to quick rallies, while outflows may signal caution.

15.2 For Long-Term Investors

For long-term investors, steady inflows confirm Bitcoin’s role as a maturing asset class. Dollar-cost averaging during consistent inflows can be a disciplined approach.

15.3 For Institutions

Institutions benefit from inflow stability, which validates Bitcoin’s place in diversified portfolios. Bitcoin spot etf inflows signal growing acceptance in traditional finance.

15.4 For Policymakers

Policymakers should view inflows as evidence of demand for regulated, transparent vehicles. Bitcoin spot etf inflows demonstrate that investors prefer legitimacy when given the option.

FAQ

1. What do bitcoin spot etf inflows mean?

They represent capital entering spot Bitcoin ETFs, reflecting investor confidence and demand for regulated crypto exposure.

2. Why is the $241 million inflow significant?

It ended a two-day outflow streak, signaling renewed optimism and strong institutional participation.

3. How do these inflows affect Bitcoin’s price?

Bitcoin spot etf inflows often correlate with bullish momentum, as higher demand supports upward price pressure.

4. Why did Ethereum ETFs see outflows while Bitcoin saw inflows?

Investors currently favor Bitcoin’s digital gold narrative, while Ethereum faces short-term uncertainty tied to competition and upgrades.

5. Are ETF flows a reliable trading signal?

They are not perfect, but sustained bitcoin spot etf inflows often align with price strength, making them a valuable sentiment indicator.

6. Can inflows continue growing long-term?

Yes, if institutional adoption accelerates and regulatory frameworks remain supportive, bitcoin spot etf inflows are likely to expand.

7. What risks could slow ETF inflows?

Regulatory crackdowns, macroeconomic shifts, or alternative investment opportunities could temporarily reduce demand.

Conclusion

The return of $241 million in bitcoin spot etf inflows marks a critical moment for digital asset markets. After two days of consecutive outflows, the surge in demand highlights both resilience and growing institutional interest. This inflow signals that despite volatility, confidence in Bitcoin’s role as a legitimate asset remains strong.

Comparisons with Ethereum underline the divergence in investor sentiment. While Bitcoin benefits from renewed inflows, Ethereum continues to experience outflows, reflecting short-term caution. Yet, both assets remain central to the digital economy, and shifts in ETF flows may evolve as narratives change.

ETF inflows are not just technical data points; they represent deeper trends of adoption, trust, and financial integration. Each rise in bitcoin spot etf inflows strengthens Bitcoin’s legitimacy, pushing it closer to mainstream status. Like gold ETFs in the past, these products are reshaping how investors access scarce assets.

For traders, ETF flows provide valuable short-term signals. For long-term investors, consistent inflows reinforce confidence in Bitcoin’s structural growth. Institutions see them as validation, while policymakers view them as evidence of demand for regulated channels.

In the bigger picture, the growth of bitcoin spot etf inflows shows that the story of Bitcoin is not just about price speculation but about integration into the fabric of global finance. The $241 million inflow is more than a headline it is a step toward Bitcoin’s enduring role in modern portfolios.