AI-Powered Altcoins Are Heating Up

AI Tokens Analysis The crypto market is entering a new phase, and this time it’s powered by artificial intelligence. From automation to predictive trading, the fusion of AI and blockchain is creating a new category of assets that’s growing faster than expected. In this AI tokens analysis, we’ll break down why TAO and VIRTUAL are standing out, why both charts are showing bullish momentum, and how traders can position themselves ahead of what could become the next mini altcoin season.

TAO Leads the AI Rally

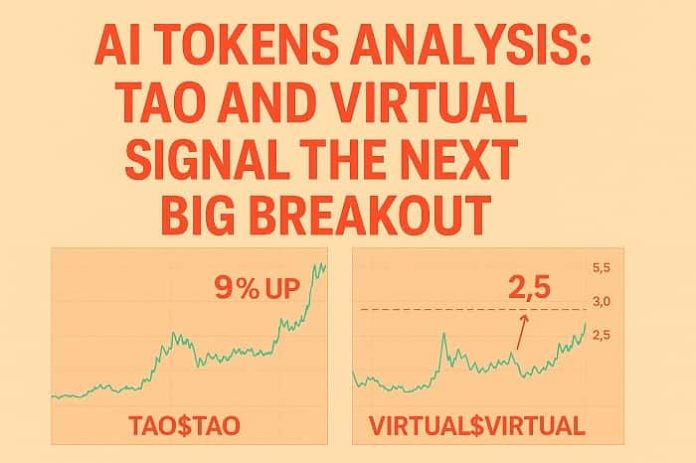

When talking about AI-driven crypto projects, TAO is emerging as a leader. Over the past week, TAO$TAO has climbed over 9%, signaling renewed investor interest and strong technical setup. According to this AI tokens analysis, TAO’s chart on the weekly time frame is showing all the hallmarks of a potential breakout pattern. The consolidation zone has tightened, and a clear resistance level around $700 is acting as the next major test. If that level is breached, TAO could move into price discovery mode — a phase where psychological and technical barriers disappear, leading to rapid movement.

VIRTUAL Gears Up for Its Own Run

VIRTUAL$VIRTUAL isn’t far behind. The weekly time frame shows increasing volume, steady higher lows, and a strong base forming just below the $2.5 resistance. As this AI tokens analysis points out, this kind of chart structure often precedes explosive rallies. A breakout above $2.5 could open the doors for a fast move toward the $3.5–$4 zone, a range not seen in months. Both TAO and VIRTUAL are now positioned as potential leaders in the AI token narrative heading into the next quarter.

Why AI Tokens Are the Market’s New Obsession

The market loves narratives, and right now, “AI” is the hottest one in tech and finance. This AI tokens analysis reveals why AI-based blockchain projects attract so much attention — they combine two megatrends: decentralized networks and artificial intelligence. Investors see AI tokens as the intersection of automation, data security, and decentralized computing power. As major tech firms continue investing billions into AI research, the crypto market is mirroring that enthusiasm through projects like TAO and VIRTUAL.

TAO’s Fundamentals Support Its Price Action

TAO is more than a trading vehicle; it’s part of the Bittensor ecosystem, a decentralized AI network that rewards contributors for training machine learning models. This AI tokens analysis underlines that TAO’s price strength isn’t based solely on hype — it’s backed by a real use case. With increasing developer activity and on-chain engagement, TAO has managed to sustain demand even during volatile periods. This kind of long-term utility often separates temporary pumps from sustainable rallies.

VIRTUAL’s Potential in the AI-Driven Web3 Space

VIRTUAL takes a different approach by merging AI tools with metaverse and digital identity solutions. According to this AI tokens analysis, its unique positioning gives it exposure not only to AI narratives but also to the rebirth of Web3 gaming and virtual economy trends. The project’s consistent updates and partnerships have helped it build quiet momentum — the kind that usually leads to sharp moves when market sentiment aligns.

Technical Outlook: Momentum Building Across the Board

From a technical standpoint, both TAO and VIRTUAL show textbook bullish setups. The AI tokens analysis highlights key indicators pointing to upward potential:

-

Higher lows forming across weekly time frames.

-

Rising RSI but not yet overbought — indicating strong but controlled momentum.

-

Volume expansion during green candles, confirming organic buying interest.

These signals, when combined, often precede multi-week rallies. If the broader altcoin market stays stable, the breakout potential in these AI tokens becomes significantly higher.

Market Sentiment: Confidence Is Returning

Traders have started to rotate back into niche sectors with strong narratives. In this AI tokens analysis, AI coins are showing the same type of capital inflow we saw during the DeFi and GameFi booms. Social sentiment metrics have also spiked, with mentions of TAO and VIRTUAL increasing sharply across crypto Twitter and trading groups. Retail investors are starting to take notice, but what’s interesting is that institutional players are quietly accumulating — a sign that the smart money sees more upside ahead.

Risk Management: The Key to Riding This Wave

Even with bullish setups, caution remains essential. The AI tokens analysis reminds traders that consolidation phases can trigger sharp corrections before breakouts. Setting stop-losses below recent support zones and scaling entries gradually are critical. For TAO, key support sits around $520–$540, while for VIRTUAL, the $2 zone remains the defense line. Risk management ensures longevity — especially in sectors that can move 20–30% in a single day.

The Bigger Picture: AI + Crypto = The Next Frontier

Beyond immediate price action, this AI tokens analysis emphasizes the macro story — the convergence of AI and blockchain technology. As data privacy, computation power, and automation become global priorities, decentralized AI networks could redefine industries from finance to healthcare. Projects like TAO and VIRTUAL represent early experiments in this direction, and if they succeed, they’ll pave the way for a whole new market segment within crypto.

TAO’s $700 Target: A Technical and Psychological Barrier

The $700 mark for TAO isn’t just a number — it’s a psychological milestone. This AI tokens analysis notes that breaking above that level could signal the beginning of a new bull phase for the token. Historically, such round-number breakouts attract momentum traders, creating self-reinforcing demand. TAO’s liquidity and structure make it ideal for such moves, especially as market sentiment improves.

VIRTUAL’s $2.5 Breakout Zone: The Gate to Acceleration

For VIRTUAL, the story is similar but on a smaller scale. The AI tokens analysis identifies $2.5 as the line separating consolidation from expansion. Once that resistance is broken, the volume and volatility could increase dramatically. Traders should watch for confirmation candles and higher closing volume to validate the breakout. Once confirmed, upside targets could extend toward $3.5 or even higher.

Altcoin Season Incoming?

Every major narrative cycle starts quietly. As this AI tokens analysis suggests, the growing performance of AI-related coins may be signaling the start of an early-stage altcoin season. Bitcoin dominance remains strong, but whenever it begins to stabilize, liquidity tends to flow into high-potential sectors — and AI is undoubtedly one of them. TAO and VIRTUAL are early indicators of that shift.

Final Thoughts: The Rise of the Machines

The bottom line of this AI tokens analysis is clear — AI tokens are no longer niche experiments; they’re becoming legitimate investment assets. TAO and VIRTUAL represent the leading edge of this transformation. Whether they break out this week or next month, the momentum is undeniable. Traders should stay alert, watch the charts closely, and prepare for volatility — because when AI meets crypto, moves can happen fast.